Have Any Questions?

+91-9760890548

Visit Us Daily

Sector-8, Rohini , New Delhi-110085

Empowering Your Financial Success, One Balance Sheet at a Time

+91-9760890548

Sector-8, Rohini , New Delhi-110085

BSA Tax and Bookkeeping services offers you the pleasure of sitting back in your business as we offer immaculate, insightful and analytical solutions for finance management of your business. We have a solution-based approach to suit your complex needs.

Sector-8, Rohini , New Delhi-110085

As the founder of BSA Tax and Bookkeeping Services, I lead an international accounting and tax practice committed to providing exceptional services to our clients.

Establish your company with confidence, backed by our expert opinions and dedicated consultancy services at BSA

Safeguard your earnings with the guidance of our experienced tax experts. We're dedicated to helping you keep more of what you

Let our experts meticulously manage your accounts, ensuring accuracy and attentiveness around the

Payroll is the process of paying a company’s employees, which includes tracking hours worked, calculating employees pay.

Unlocking Your Business Potential, One Solution at a Time

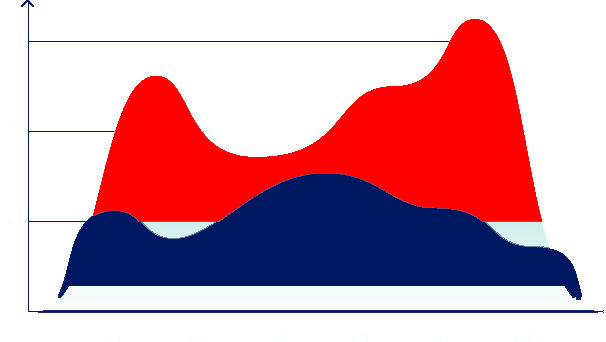

At BSA Tax and Bookkeeping Services, we believe in the power of impeccable financial management to drive business success. Our philosophy revolves around providing immaculate, insightful, and analytical solutions tailored to meet the diverse needs of our clients.

At BSA Tax and Bookkeeping Services, our philosophy revolves around placing the needs and aspirations of our clients at the forefront of everything we do. We believe in building lasting relationships based on trust, transparency, and mutual respect.

We believe in the power of continuous innovation to stay ahead in an ever-evolving financial landscape. Our philosophy is rooted in embracing change, exploring new technologies, and adopting best practices to deliver cutting-edge solutions to our clients.

Our mission at BSA Tax is to empower businesses of all sizes with comprehensive financial management solutions. We aim to alleviate the burden of financial administration by providing impeccable services in accounting, bookkeeping, taxation, and more.

Our mission is to empower businesses with comprehensive financial management solutions, enabling them to achieve their goals and thrive in competitive markets.

We are dedicated to driving long-term success for our clients and communities through our expertise, innovation, and commitment to excellence.

BSA Tax envisions a future where businesses can flourish without being hindered by financial complexities. We aspire to be the leading provider of innovative financial solutions, setting new standards of excellence in the industry. Our vision is to create a more equitable society where trust, confidence, and prosperity are accessible to all.

Our vision is to set new standards of excellence in the financial services industry, pioneering innovative solutions that inspire trust and confidence among our clients and peers.

We envision a future where businesses flourish, communities thrive, and prosperity is accessible to all, driven by our unwavering commitment to making a positive impact in society.

Our services streamline your company's tax operations, allowing you to focus on core business activities while we handle all tax-related tasks efficiently and effectively.

Benefit from our best-in-class industry practices, tailored to suit the diverse needs of businesses across various sectors. We employ cutting-edge strategies to ensure compliance and maximize tax savings.

At BSA Bookkeeping Services, we have a dedicated team of experienced professionals ready to provide dynamic solutions to your tax challenges. Our experts stay abreast of the latest tax regulations and employ innovative techniques to optimize your tax position.

We leverage state-of-the-art technology to enhance our service delivery, offering you seamless access to real-time data and insights. Our advanced tools and systems streamline processes, improve accuracy, and ensure timely compliance.

With BSA Bookkeeping Services as your trusted partner, you can expect more than just cost savings. Our comprehensive solutions are designed to drive efficiency, mitigate risks, and support your business growth objectives.

Choose us for unparalleled expertise, efficiency, and reliability in tax and bookkeeping services, tailored to elevate your business success.

Benefit from our team of seasoned professionals with extensive experience in tax and bookkeeping services.

Streamline your operations with our efficient processes and cutting-edge technology, saving you time and resources.

Enjoy cost savings with our integrated solutions that offer maximum value without compromising quality.

We are working in the format of an outsourcing project office.

We are working in the format of an outsourcing project office.

Receive personalized solutions tailored to your specific business needs and industry requirements.

Rely on our dedicated team to deliver reliable and consistent service, ensuring peace of mind for your business operations.

We are working in the format of an outsourcing project office.

Shivam Agrawal is a Chartered Accountant ana a fellow member of the institute of Chartered Accountants of India (ICAI). He is the founder of BSA Tax and Bookkeeping Services and leads the international accounting and tax practice.

Director at BSA Tax and Bookkeeping Services, he is backed by more than 7 years of experience serving clients across Taxation, Auditing, and Financial services domains in the U.S., U.K., Australia and Canada. His expertise lies in unique tax issues, strategic planning, and compliance services. Shivam has helped clients of all sizes achieve efficient global tax structures and has spent significant time focused on U.S. tax accounting issues and real estate services. He excels in assessing and implementing business transformation initiatives.

TRUSTED

CLIENTS

Finished & Supported

Incredible Projects

Years of Experience

& Business Consulting

VISITED

CONFERENCES

Please, fulfill the form to get a consultation. After processing the data, a personal manager will contact you.